How to Calculate Mortgage on Your Site Using a Mortgage Calculator Plugin

Share :

We will never spam you. We will only send you product updates and tips.

You want to own a home but you don’t have enough money to spend on it, right?

Ok, got it…!

No worries, you can have a smart option out there in the field. On that occasion, you might need to lend the required amount of money from the bank as a mortgage. This could be a great option for serving your purpose. So, apparently, you need a good amount of research to figure out the true cost requires.

What could be more efficient ways to accomplish the process?

Certainly, you can make it happen by using a quality mortgage calculator plugin.

Becoming a homeowner is usually a complicated process and if-if happens after landing money then it’s going more intricate one. Not only that but also it’s a major financial commitment, and figuring out the true cost requires a good amount of research. Many people often turn to online mortgage calculators to manage what they can afford, but this tool sometimes comes with a few obvious shortcomings.

Many people often turn to online mortgage calculators to manage what they can afford, but this tool sometimes comes with a few obvious shortcomings.

Today, I am going to describe how to calculate mortgage payment rates and other related stuff using a super plugin on your site. This is the Ninja Mortgage Calculator plugin which makes the things done in a more easy and convenient way.

The plugin has three different options for calculating the whole mortgage calculation. Let your visitors calculate their payments based upon the interest rates and loan amount they preferred they will get their reports in detail.

Before going to the observation of the details, I would like to go through a couple of basic issues so that the article would be more understandable and flexible for its expected readers. Basically, I will try to cover the basics of those three ingredients before going through the practical interpretation.

What’s All About?

The mortgage is a long-term loan that is designed to buy a particularly big-budget asset like house and in order to repay the principal you have to make an interest payment to the lender. This loan is a safe loan because the loan is provided against the exchange of a particular asset as collateral.

It means that the lender, in many cases a bank happens to be the lender who has the right to seize the property in the event that the borrower fails to pay them back. So, to know and use, how to calculate mortgage payment is very much crucial for demonstrating on your website.

Moreover, as a loan taker, you have to provide a down payment at a minimum rate of percentage. From the general point of view, we calculate the total loan amount, down payment, mortgage term in a year, and most importantly annual interest rate, etc.

1. Mortgage Refinance

Mortgage refinancing is the method of repairing your mortgage or mortgages on your property with a new mortgage, generally with different terms than the original mortgage. The main aim of the refinance is to standardize the mortgage policy. In refinance, usually, the interest rate reduces and enlarges the mortgage term to make things easier for the borrower.

Someone gets confused by merging mortgage refinancing with a second mortgage, but both are not the same. A second mortgage is an extension to your first mortgage and it does not replace it. Mortgage refinancing will implement new money to the borrower, and used to pay off the original mortgage, usually with better mortgage terms.

Getting a new mortgage to replace the original one is called mortgage refinancing. Refinancing is done to allow a borrower to secure a better interest term and rate. The first loan is paid off, allowing the second loan to be created, instead of simply making a new mortgage and driving out the original mortgage.

2. Mortgage Payments

Mortgages come in many forms and formats. Like a fixed-rate mortgage, the lend taker pays the same interest rate during the term of the loan. Borrower’s monthly principal and interest payment never change from the first mortgage payment to the last. In most of the cases, fixed-rate mortgages have a 15- or 30-year term of the loan.

Here note that if market interest rates rise, the payment of the loan taker doesn’t change. If market interest rates get down significantly, the borrower may accomplish to secure that lower rate by refinancing the mortgage.

The key factor of knowing how to calculate mortgage payment is the size and the term of the loan. The size here is the amount of money you borrow and the term is the span of time or duration of paying it back. In general the longer your term, the lower your payment rate. That’s why we see in the practical 30-years term is more popular.

Therefore an easy way to compare mortgage types and various calculations regarding the issue is to use a mortgage calculator. Now, I am going to use Ninja Mortgage Calculator for demonstrating all the aspects of mortgage calculation.

3. How Does It Work

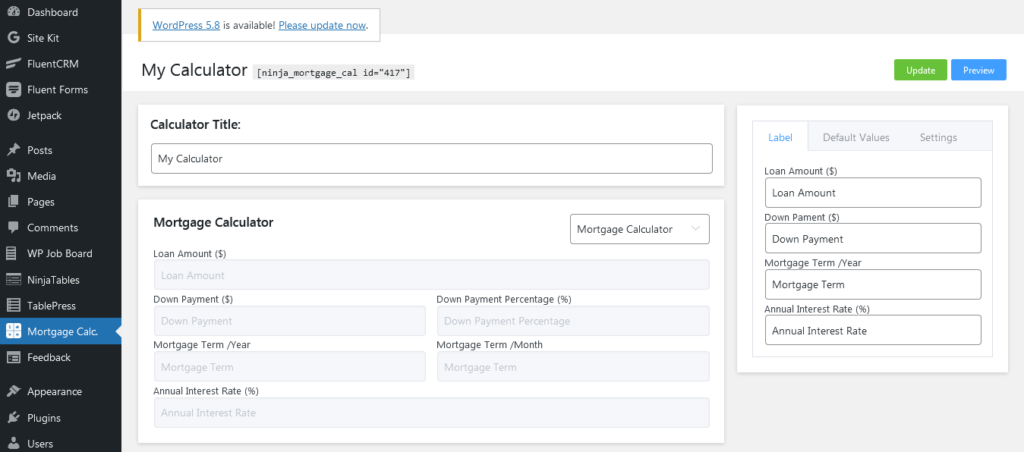

As I am going to use a plugin in order to demonstrate the whole process of the mortgage calculator, you need to have a WordPress based website where you have to use the WordPress plugin. I think you are a WordPress user and the thing you have to do now is to install the Ninja Mortgage Calculator plugin. Then you will find the plugin interface where you can calculate by following all the procedures.

4. Using a Proper Plugin

Choosing the right plugin from the mess is always a challenging matter. I am using here a quality plugin named Ninja Mortgage Calculator. After activating the plugin, now, the plugin is ready to use. Using the plugin you will find three functionalities in one device. They are such: 1. Mortgage Calculator, 2. Mortgage Refinance Calculator 3. Mortgage Payment Calculator.

Let’s get into a bit of details discussion about these 3 plugins.

i. Mortgage Calculator

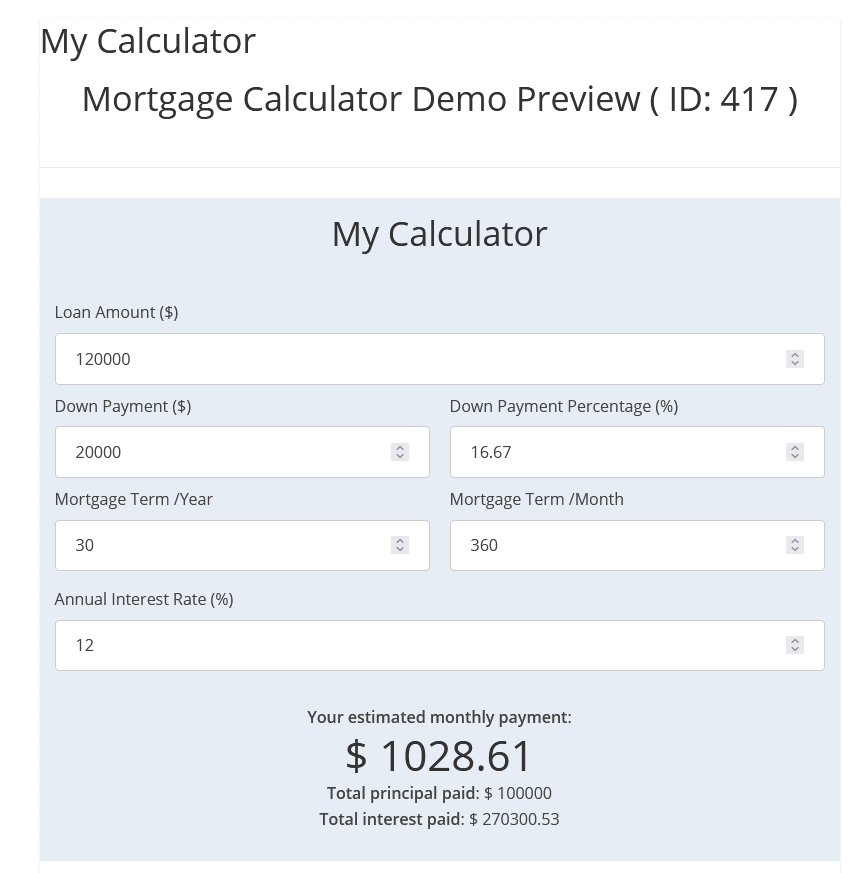

This is the first ingredient of the Ninja Mortgage Calculator plugin. In this plugin, Mortgage Calculator allows you to calculate your total loan amount, down payments, amortization terms and provides you authentic feedback regarding the required amount of monthly payments you have to pay. As an admin, you can configure all the settings staying from the admin panel.

This above output of this interface can be set for your expected visitors. Now, if you want to show the amortization of that particular mortgage, you just need to click on the Payment Schedule button located in the below, you will see all the output as given below through a snapshot.

The above image shows the total calculation of two years mortgage with a visual outlook. This is a very simple way to show your mortgage data. You can visualize even in two more ways of your entire mortgage calculation. They are Mortgage Refinance and Mortgage Payment. Now let’s have a look at how Mortgage Refinance works for you.

ii. Mortgage Refinance Calculator

In Mortgage Refinance, you can set your total to refinance necessarily in order to mitigate the interest rate. Using Ninja Mortgage Calculator you also can refinance your mortgage in a precise way. The prime aim of the refinance is to the reduction of the interest rate.

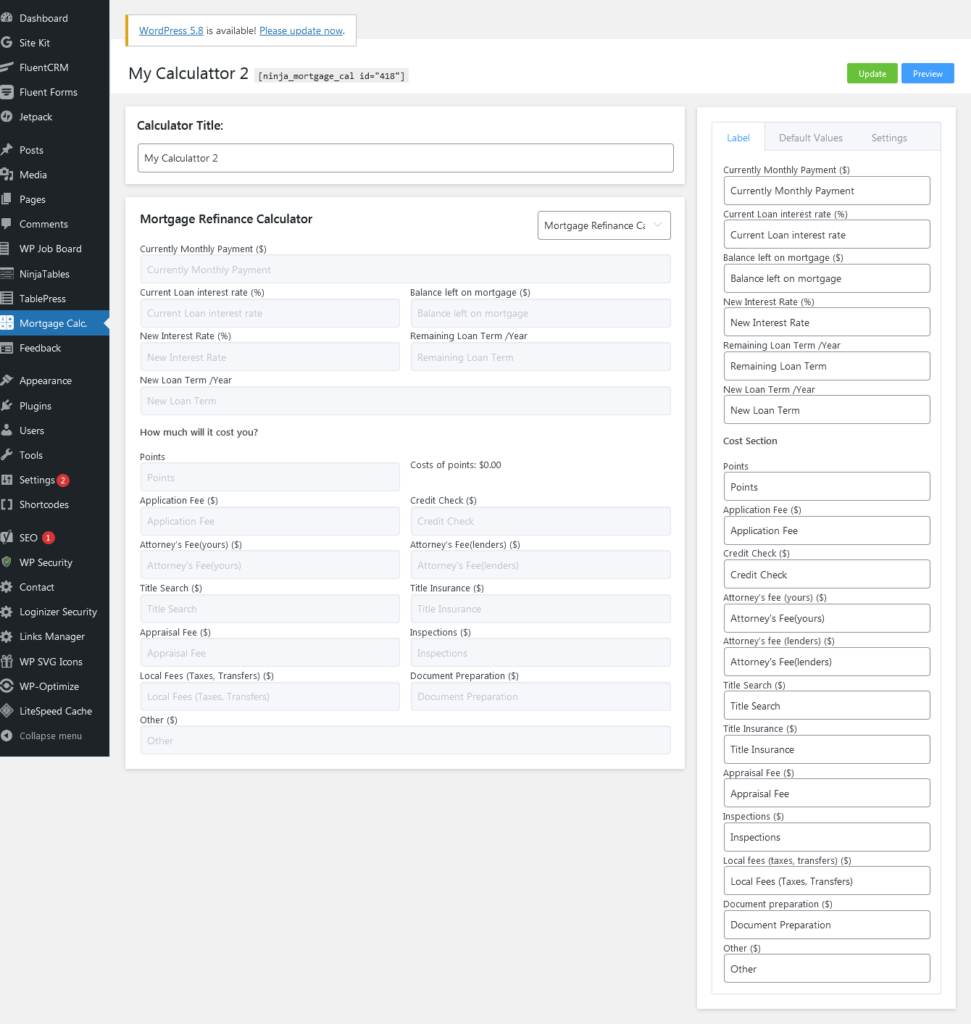

It’s due to make a balance between an affordable monthly payment and reducing your borrowing costs. You just need to install the plugin and simply you can do all these things just by operating the plugin. The plugin makes every refinance mortgage easy for you. Here is a snapshot of the admin panel interface using the Ninja Mortgage Calculator plugin.

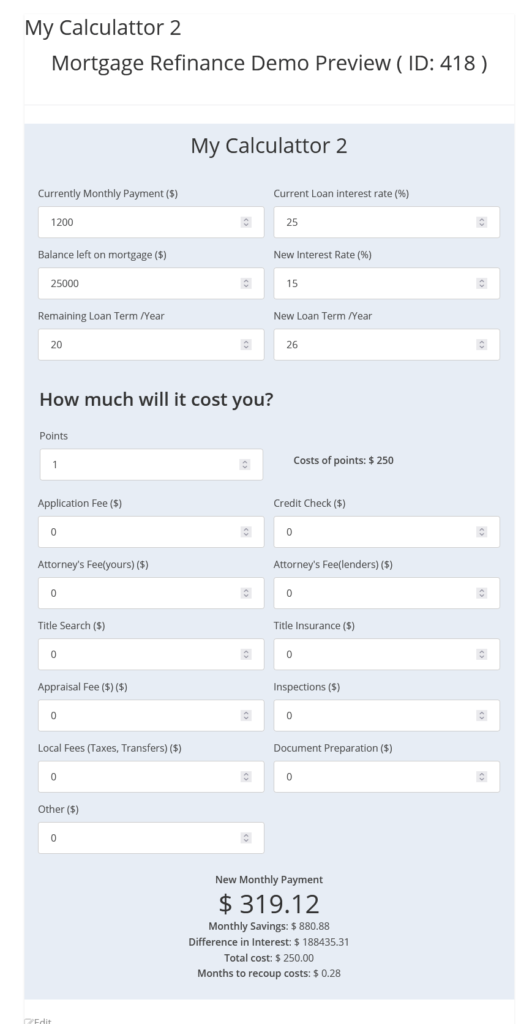

The final output of the above interface is given below. Here, we see interest rate has reduced and loan term also enlarged to make the things easily payable.

Here, in the image, we see the ultimate monthly payment is $330.38 which is much less than that previous one. At the same time span of the loan, repayments have increased so that it would be much easier for the borrower to pay the debt in time. This is how you can use the plugin for the mortgage refinance calculation purpose.

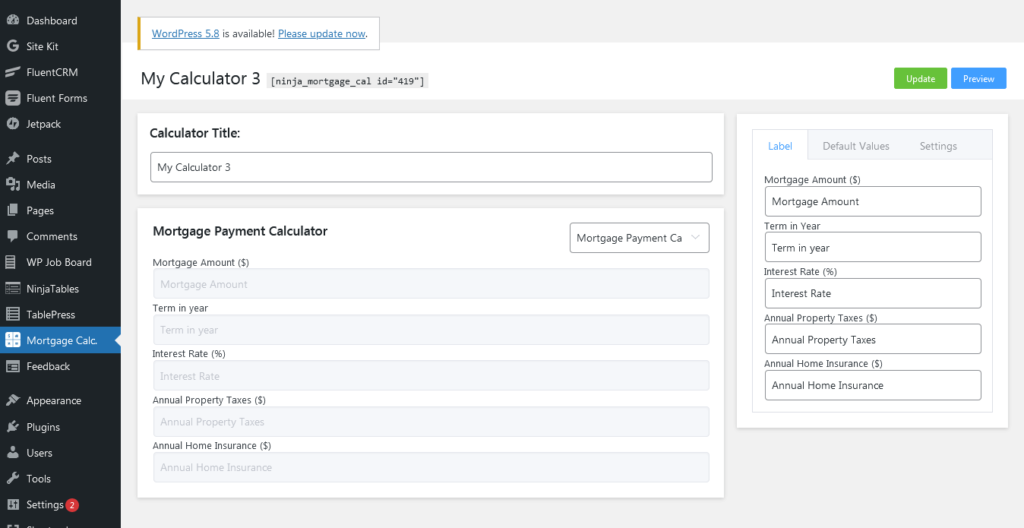

iii. Mortgage Payment Calculator

There is another calculation you can have using the plugin which is a mortgage payment calculator. This feature is for calculating PITI means Principal, Interest, Taxes, and Insurance.

You will get five input fields including Annual Property Taxes and Annual Home Insurance. Then you can calculate monthly payments based on PI and PITI where for PI, the

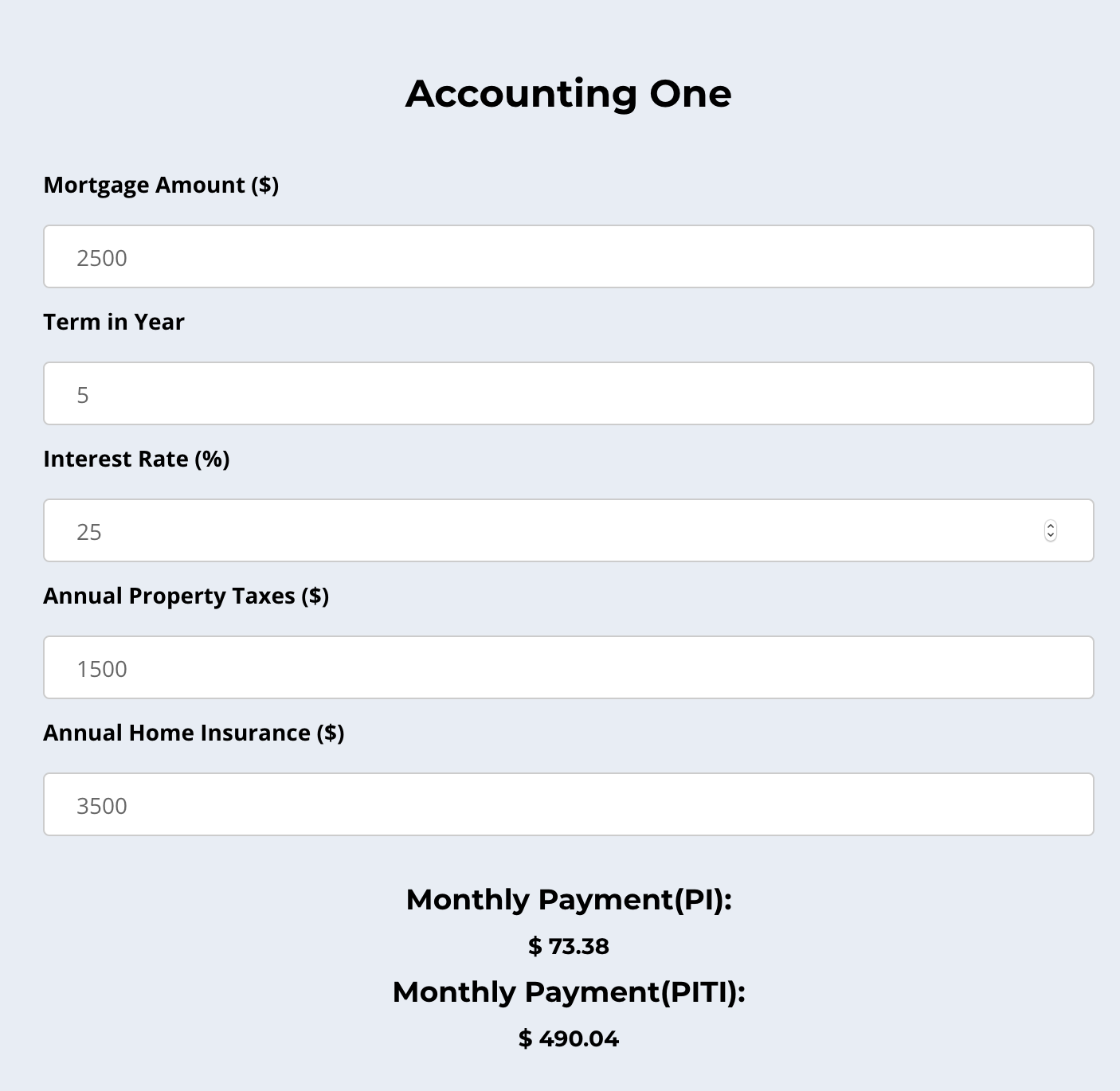

Here, you see that

This is what the output of the Mortgage Payment we can have based on PT and PITI. This is the last feature that can be used to figure out the actual monthly payment based on principal, interest, taxes, and insurance.

Final Words

In a nutshell, I can say that Ninja Mortgage Calculator is the total package of three tools of different functionalities. Using this tool, you can show easily how to calculate mortgage payments on your website.

The plugin itself works altogether as a general mortgage calculator which shows the monthly payment with principal paid and interest paid, as a mortgage refinance calculator which show monthly payment with savings, a difference in interest, the total cost and the recoup cost, and last as a mortgage payment calculator which shows the result with PI and PITI.

I hope the article helped you people so much and you would appreciate the whole write-up. If you want to share anything on the topic, simply leave a comment in the comment section below.

[ninja_table_banner]

Related Posts

Comments

-

[…] Source: How to Calculate Mortgage on Your Site Using Mortgage Calculator Plugin […]

-

[…] Ninja Mortgage Calculator adds a range of calculation tools including refinance and payment calculators, it may not provide […]

Leave a Reply

You must be logged in to post a comment.